Ever get that sinking “Sunday Scaries” feeling? That dread that creeps in as the weekend ends, knowing you have to drag yourself back to a job that… well, pays the bills?

I know that feeling so well. For years, I felt chained to my desk, checking my bank account before booking a dentist appointment, and feeling guilty for taking a sick day. My work-life balance was a joke, and I was just… stuck.

That feeling of being stuck is the exact opposite of financial freedom.

If you’re here, you’ve probably heard the term thrown around, maybe imagining people who retired at 30 to sail yachts. But here’s the good news: it’s not just for multi-millionaires. So, what is financial freedom? A complete beginner’s guide for 2025 is exactly what you need. It’s about taking back control. It’s about options. And in this post, I’m going to break down exactly what it is (no confusing jargon, I promise) and how you can start your own journey, one small step at a time.

So, What is Financial Freedom, Really? (It’s Not Just About Being Rich)

Let’s get this out of the way: Financial freedom isn’t about having a garage full of Lamborghinis. It’s not (necessarily) about being a millionaire.

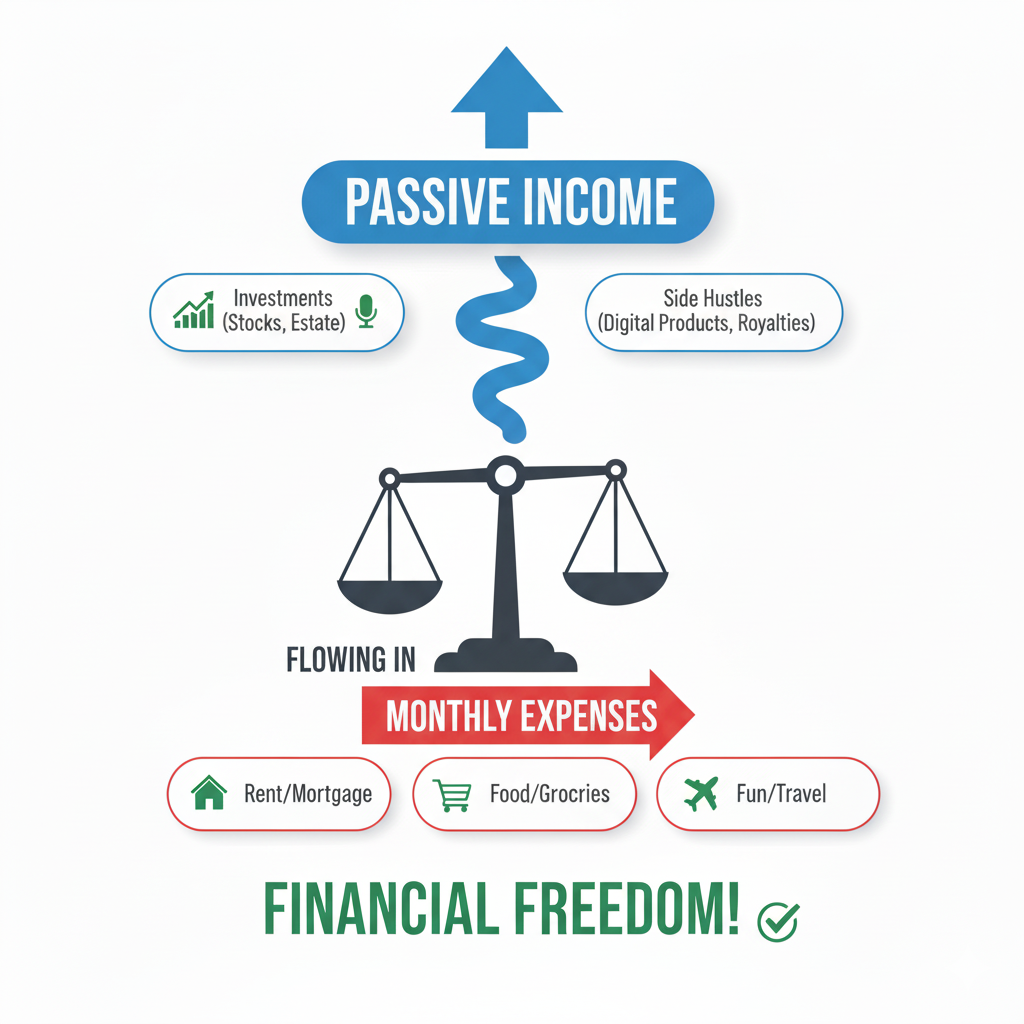

At its core, financial freedom is the point where your assets generate enough passive income to cover your living expenses.

In simpler terms: You have enough money working for you (from investments, rental properties, or businesses) that you no longer have to trade your time for a paycheck to survive.

I used to think financial freedom meant “never working again.” But I’ve realized that’s not it. For me, and for many others, it’s about choice.

- It’s the freedom to choose work you love, regardless of the salary.

- It’s the freedom to go part-time to raise your kids or care for a parent.

- It’s the freedom to take a six-month sabbatical to travel the world.

- It’s the freedom to walk away from a toxic boss without panicking about your next meal.

It’s about your money serving you, not the other way around.

Why Chasing Financial Freedom is About More Than Just Money

When I first started, I was obsessed with the number. How much did I need to save? How fast could I grow my investments? It was all about the math.

But I quickly burned out. It wasn’t until I focused on the why that everything clicked.

This journey is about buying back your most valuable, non-renewable resource: your time. It’s the ultimate expression of work-life balance. Think about what you’d do if you didn’t have to go to your 9-to-5. Would you start that nonprofit? Write a novel? Learn to surf?

It’s also about your health. The American Psychological Association (APA) consistently finds that money is a significant source of stress for Americans. I know how that stress feels—it’s a heavy blanket that affects your sleep, your relationships, and your focus.

Chasing financial freedom is an act of personal wellness. It’s about building a life where you’re not constantly reacting from a place of scarcity and stress. A friend of mine, “Sarah,” recently hit her “Coast FI” number (more on that later). She didn’t quit her job. Instead, she dropped to 20 hours a week at her graphic design gig. She now spends her afternoons volunteering at an animal shelter. That’s freedom.

The 4 “Levels” of Financial Freedom (Find Your First Milestone)

Financial freedom isn’t an all-or-nothing switch. It’s a spectrum, a ladder with different rungs. Seeing it this way made the whole thing feel so much more achievable for me.

You might be on this ladder already!

- Level 1: Financial Stability. You’ve got an emergency fund. You have 3-6 months of living expenses saved. A surprise $1,000 car repair is an annoyance, not a disaster. This is the foundation.

- Level 2: Financial Flexibility. You have 1-2+ years of expenses saved. This is “FU money.” It gives you the power to leave that bad job, take a risk on a new career, or start your own thing.

- Level 3: Financial Independence (Lean FI). This is the classic definition. Your passive income now covers your basic living expenses (rent, food, utilities). You could technically stop working, but you’d be living a lean, minimalist lifestyle.

- Level 4: Financial Abundance (Fat FI). Your passive income covers your desired lifestyle, including travel, hobbies, and luxuries, with plenty left over.

💡 Pro Tip: Don’t aim for Level 4 right out of the gate. Aim for Level 1. The peace of mind that comes from just having a fully-funded emergency fund is a massive win and will give you the confidence to keep going.

The 2 Core Pillars: How You Actually Build Financial Freedom

Okay, so how do we do this? It sounds great in theory, but where does the rubber meet the road?

It boils down to two, and only two, core pillars. You don’t need complicated crypto schemes or a “secret” stock-picking algorithm.

Pillar 1: Increase Your Savings Rate Your savings rate is the percentage of your income you save and invest. This is the single most important lever you can pull. You can increase it in two ways:

- Spend Less: This is about “conscious spending,” not “miserable deprivation.” Track your spending for one month. I bet you’ll find $100+ leaking out to subscriptions you forgot or lunches you didn’t even enjoy. If you’re just starting, our guide on how to save your first $1,000 in 90 days is a great place to start.

- Earn More: There’s a limit to how much you can cut. There’s no limit to how much you can earn. In 2025, the gig economy and remote work make this more possible than ever. Drive for Uber, do freelance writing, or learn a new skill. (We’ve got a great list of 10 side hustles you can start this weekend if you need ideas).

Pillar 2: Invest Your Savings (This is the Magic Part) You cannot save your way to financial freedom. Inflation will eat your cash. You must invest.

This is where people get scared. They picture The Wolf of Wall Street. But here’s the secret: boring is beautiful. For most of us, the best path is simply buying low-cost index funds (which are just baskets of hundreds or thousands of stocks) and leaving them alone.

This lets you benefit from compound interest, which is just your money making babies, and then those babies making more babies. As resources like Investor.gov show, a small amount invested regularly can grow into a massive nest egg over time.

My Biggest Mistake: What Not to Do on Your Journey

When I first got a “real” job with a decent salary, I made the classic mistake: lifestyle creep.

I got a raise, so I got a nicer apartment. I got a bonus, so I bought a nicer car. I was making way more money than just a few years prior, but I was still living paycheck-to-paycheck. My savings rate was 0%. I was on a “hedonic treadmill,” running faster just to stay in the same place.

My “aha!” moment came when I had to pay a $600 vet bill on my credit card. I felt so ashamed. I was a “successful professional” who couldn’t handle a minor emergency.

⚠️ Watch Out: Lifestyle creep is the silent killer of financial freedom. The single best thing you can do is save and invest half of every raise you ever get. You still get to upgrade your life with the other half, but your freedom-building machine gets a massive boost. This one change has been critical to my journey and helped me find a better work-life balance because I wasn’t just working to pay for more stuff.

Getting Started in 2025: Your First 3 Actionable Steps

This all sounds like a lot, right? I get it. It’s easy to get overwhelmed and do nothing.

Let’s not do that. Here are three tiny, simple things you can do this week.

- Define Your “Why.” Forget the math for a second. Get out a notebook and write down what financial freedom means to you. What would you do? How would you feel? Be specific. “I want to wake up without an alarm and spend my mornings reading.” “I want to be able to fly home to see my family whenever I want.” This “why” will pull you through the hard days.

- Calculate Your Number (The Simple Way). Here’s a basic rule of thumb called the “4% Rule.” Take your annual expenses and multiply them by 25. That’s your “FI Number.”

- Example: You spend $40,000 a year.

- Your Number: $40,000 x 25 = $1,000,000.

- This number might seem impossible. Ignore it for now. It’s just a compass, not a destination. Your first goal is Step 3.

- Automate Your First $100. This is the most important step. Log into your bank. Set up an automatic transfer from your checking account to a high-yield savings account (for your emergency fund) that happens the day you get paid. It can be $100. It can be $25. The amount doesn’t matter. The habit is what matters.

✨ Quick Win: Do Step 3 right now. Seriously. It takes five minutes. Go do it. I’ll wait. …Done? Amazing. You just took your first real step toward financial freedom.

It’s a Marathon, Not a Sprint

Look, this isn’t a “get rich quick” scheme. This is a “get rich slow, but guaranteed” plan.

Financial freedom isn’t a myth reserved for tech billionaires. It’s a tangible, achievable goal for regular people—for professionals, freelancers, and students who are willing to be intentional.

I’m still on my journey, and you know what I’ve learned? The process itself brings peace. Just knowing I have a plan, seeing my emergency fund grow, and watching my investments tick up… it’s already removed 90% of the financial stress from my life, long before I’ve “crossed the finish line.”

You can have that, too. You just have to start.

What’s your biggest challenge or question about financial freedom? Share in the comments below! Let’s talk about it.

FAQs: Your Financial Freedom Questions Answered

Q: How much money do I really need to be financially free? A: The most common benchmark is the “25x Rule.” Multiply your ideal annual expenses by 25. If you want to live on $50,000 a year, you’d aim for $1.25 million. This isn’t a perfect, rigid rule, but it’s a great starting point for setting a long-term goal. Your first goal, however, should be a 3-6 month emergency fund.

Q: Is financial freedom even possible on a low income? A: Yes, but it requires more focus. On a low income, your best strategy is to focus aggressively on Pillar 1: Earning More. Cutting expenses can only get you so far. Use your time to develop new skills, find a high-impact side hustle, or work toward a promotion. Every extra dollar you earn should go directly toward saving and investing.

Q: What’s the fastest way to achieve financial freedom? A: The “fastest” way is to have a very high savings rate (50%+). This comes from a combination of high income and low expenses. But “fast” can also lead to burnout. The best way is the sustainable way. Avoid high-interest debt (like credit cards), automate your investments, and focus on consistency over a long period.

Q: Do I have to give up everything I love, like coffee and vacations? A: Absolutely not! This is a common myth. It’s not about deprivation; it’s about prioritization. You’re just making a conscious choice. You’re saying, “I’d rather invest $200 this month than buy more clothes I don’t need, because my future freedom is more valuable to me.” You can—and should—budget for the things you love.